Within the real estate industry, terms are often used that can quickly lead to confusion, as they sound similar but have different meanings: Standard land value, land value and market value.

Although standard land values differ from area to area, there is only one type that is defined in a standardized procedure by the expert committees regardless of the location of the standard land value zone. The standard land value serves as a reference for determining the land value. This denotes the specific value of an individual plot of land.

To determine the provisional land value, the standard land value is first multiplied by the plot size. The formula therefore applies:

Standard land value (Euro/m²) x plot area (m²) = provisional land value (Euro)

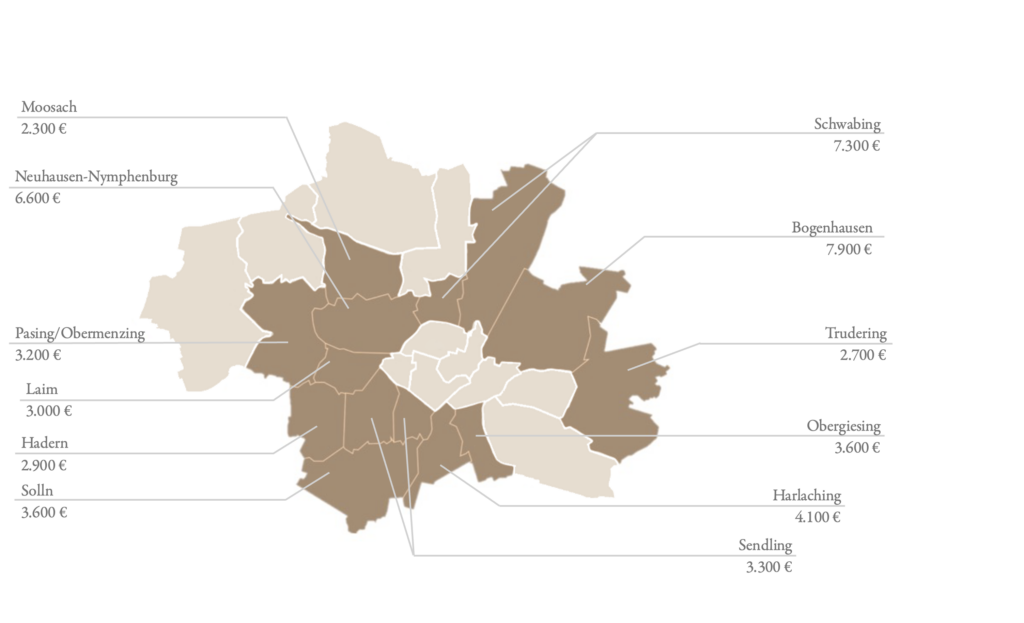

Two examples: A plot of land in the sought-after Munich district of Nymphenburg has a standard land value of EUR 6,600 per m² as at 01.01.2024. The size is 500 m². This results in a value of 6,600 euros/m² x 500 m² = 3,300,000 euros.

In the Moosach district, the standard land value is significantly lower at 2,300 euros/m². Here, the land value for the same plot size would be EUR 2,300/m² x 500 m² = EUR 1,150,000.

However, many other factors influence the determination of the land value. A real estate expert is therefore required to calculate this accurately.

This leaves the market value. This is the price that can actually be achieved when selling a property on the open market. This includes not only the land value, but also the value of any existing buildings and other facilities.